Year-end Tax Report

- 20

- Oct

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing tax environment is a key component to helping our clients benefit from potential tax reduction strategies.

Other than some IRS inflation adjustments, calendar year 2023 has brought limited changes in tax laws for individuals. This report focuses on information that could be helpful for individuals in conjunction with tax planning for calendar year 2023. It also has a section that shares some of the tax laws that are currently set to sunset at the end of 2025.

Remember, the Tax Cuts and Jobs Act (TCJA) enacted in 2017 brought many changes to the tax code. The Tax Cuts and Jobs Act included many provisions for individuals that took effect in 2018 but are currently set to expire after 2025. One big uncertainty for all taxpayers is what will happen to the tax code after 2025.

As financial professionals, we try to be proactive. The primary objective of this report is to share strategies that could be effective if considered and implemented before year-end. Please note that this report is not a substitute for using a tax professional. In addition, many states do not follow the same rules and computations as the federal income tax rules. Make sure you check with your tax preparer to see what tax rates and rules apply for your state.

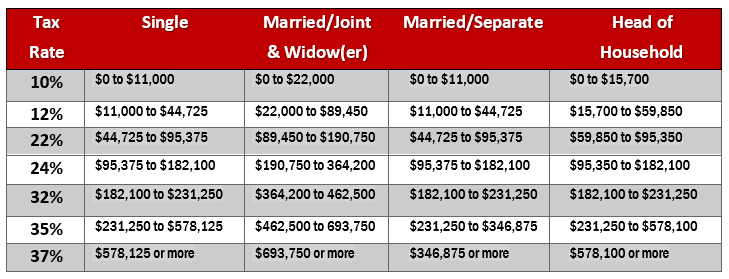

Income Tax Rates for 2023

For 2023 there are still seven tax rates. They are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Under current law this seven-rate structure will phase out on January 1, 2026.

Year-end Tax Planning for 2023

One of our foremost goals is to help our clients try to optimize their tax situations. This report offers many suggestions and reviews of strategies that can be useful to achieve this goal.

Everyone’s situation is unique, but it is wise for every taxpayer to begin their final year-end planning now! Choosing the appropriate tactics will depend on your income as well as several other personal circumstances. As you read through this report it could be helpful to note those strategies that you feel may apply to your situation so you can discuss them with your tax preparer.

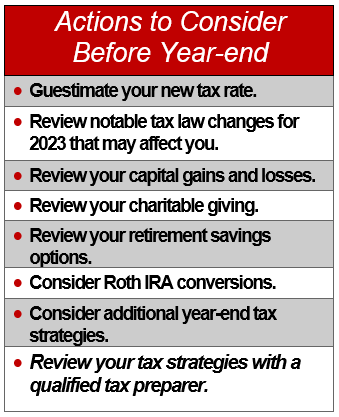

Some items to consider include:

Evaluate the use of itemized deductions versus the standard deduction.

For 2023 tax returns, the standard deduction amounts will increase to $13,850 for individuals and married couples filing separately, $20,800 for heads of household, and $27,700 for married couples filing jointly and surviving spouses.

As a reminder, the Tax Cuts and Jobs Act roughly doubled the standard deduction. Its goal was to decrease tax payments for many of those who typically claim this standard deduction. Although personal exemption deductions are no longer available, the larger standard deduction, combined with lower tax rates and an increased child tax credit, could result in less tax. You should consider running the numbers to assess the impact on your situation before deciding to take itemized deductions.

The TCJA still eliminates or limits many of the previous laws concerning itemized deductions. An example is the state and local tax deduction (SALT), which is still currently capped at $10,000 per year ($5,000 for married filing separately).

Consider bunching charitable contributions or using a donor-advised fund.

For those taxpayers who are charitably inclined, it makes sense to think about a plan. One way to utilize the tax advantages of charitable contributions is through a strategy referred to as “bunching”. Bunching is the consolidation of donations and other deductions into targeted years so that in those years, the deduction amount will exceed the standard deduction amount.

Another strategy is to consider using a donor-advised fund. A donor-advised fund, or DAF, is a philanthropic vehicle established at a public charity. It allows donors to make a charitable contribution, receive an immediate tax benefit and then recommend grants from the fund over time. Taxpayers can take advantage of the charitable deduction when they’re at a higher marginal tax rate while actual payouts from the fund can be deferred until later. It can be a win-win situation. If you are charitably inclined and need some guidance, please call us and we can assist you.

Review your home equity debt interest.

For mortgages taken out after October 13, 1987, and before December 16, 2017 (i.e., entered into a binding contract by that date), mortgage interest is fully deductible up to the first $1,000,000 of mortgage debt incurred to acquire or improve a qualified residence. The TCJA lowered the threshold to $750,000 or $375,000 (married filing separately) for homes purchased after December 15, 2017, but before January 1, 2026. All interest paid on any mortgage taken out before October 13, 1987, is fully deductible regardless of your mortgage amount (“grandfathered debt”). Many mortgage holders refinanced for lower rates or to cash out in the last few years, so remember, to the extent debt increases the interest might not be deductible.

Interest on home equity lines of credit (HELOCs) and cash-out refinancings may be deductible as well if the funds were used to improve the home that secures the loan (or if the proceeds were invested). Please share with your tax preparer how the proceeds of your home equity loan were used. If you used the cash to pay off credit cards or other personal debts, the interest is not deductible, but that may change when the TCJA sunsets at the end of 2025.

Revisit the use of qualified tuition plans.

Qualified tuition plans, also named 529 plans, are a great way to tax efficiently plan the financial burden of paying tuition for children or grandchildren to attend elementary or secondary schools. Earnings in a 529 plan originally could be withdrawn tax-free only when used for qualified higher education at colleges, universities, vocational schools or other post-secondary schools.

However, they changed that so 529 plans can now be used to pay for tuition at an elementary or secondary public, private or religious school, up to $10,000 per year. Unlike IRAs, there are no annual contribution limits for 529 plans. Instead, there are maximum aggregate limits, which vary by plan. Under federal law, 529 plan balances cannot exceed the expected cost of the beneficiary’s qualified higher education expenses. Limits vary by state. Some states even offer a state tax credit or deduction up to a certain amount.

Contributions to a 529 plan are considered completed gifts for federal tax purposes, and in 2023 up to $17,000 per donor, per beneficiary, qualifies for the annual gift tax exclusion. Excess contributions above $17,000 must be reported on IRS Form 709 and will count against the taxpayer’s lifetime estate and gift tax exemption amount ($12.92 million in 2023).

There is also an option to make a larger tax-free 529 plan contribution if the contribution is treated as if it were spread evenly over a 5-year period. A lump sum contribution of up to $85,000 ($17,000 x 5) can be made to a 529 plan in 2023. No other gifts can be made to the same beneficiary, however, front-end loading the gift allows for additional tax-free compounding. Parents of grandparents sometimes use this 5-year gift-tax averaging as an estate planning strategy. If you want to explore setting up a 529 plan, call us and we would be happy to assist you.

Maximize your qualified business income deduction (if applicable).

One of the most talked about changes from the Tax Cuts and Jobs Act enacted in 2017 is the qualified business income deduction under Section 199A. Current proposals want to change this deduction, but for 2023, taxpayers who own interests in a sole proprietorship, partnership, LLC, or S corporation may be able to deduct up to 20% of their qualified business income. Please be careful because this deduction is subject to various rules and limitations. In 2023, limits on this deduction begin phasing in for taxpayers with income above $364,200 for those married filing jointly taxpayers (and $182,000 for all other filers).

There are planning strategies to consider for business owners. For example, business owners can adjust their business’s W-2 wages to maximize the deduction. Also, it may be beneficial for business owners to convert their independent contractors to employees where possible, but before doing so, please make sure the benefit of the deduction outweighs the increased payroll tax burden and cost of providing employee benefits.

Other planning strategies can include investing in short-lived depreciable assets, restructuring the business, and leasing or selling property between businesses. This piece of the tax code is complicated and would take an entire report to discuss, so we recommend that if you are a business owner, you should talk with a qualified tax professional about how this new Section 199A could potentially work for you.

Consider All of Your Retirement Savings Options for 2023

If you have earned income or are working, you should consider contributing to retirement plans. This is an ideal time to make sure you maximize your intended use of retirement plans for 2023 and start thinking about your strategy for 2024. For many investors, retirement contributions represent one of the smarter tax moves that they can make. Here are some retirement plan strategies we’d like to highlight.

401(k) contribution limits increased. The elective deferral (contribution) limit for employees under the age of 50 who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $22,500. The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $7,500 ($30,000 total). As a reminder, these contributions must be made in 2023.

IRA contribution limits increase. The limit on annual contributions to an Individual Retirement Account (IRA) are increased in 2023 to $6,500 for individuals. The additional catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000 (for a total of $7,500). IRA contributions for 2023 can be made all the way up to the April 15, 2024, filing deadline.

Higher IRA income limits. The deduction for taxpayers making contributions to a traditional IRA is phased out for singles and heads of household who are covered by a workplace retirement plan and have modified adjusted gross incomes (MAGI) of $73,000 to $83,000. For married couples filing jointly, in which the spouse who makes the IRA contribution is covered by a workplace retirement plan, the income phase-out range is $116,000 to $136,000.

For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the deduction is phased out in 2023 as the couple’s income reaches $218,000 and completely at $228,000. For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range remains at $0 to $10,000 for 2023. Please keep in mind, if your earned income is less than your eligible contribution amount, your maximum contribution amount equals your earned income.

Increased Roth IRA income cutoffs. The MAGI phase-out range for taxpayers making contributions to a Roth IRA is $218,000 – $228,000 for married couples filing jointly in 2023. For singles and heads of households, the income phase-out range is $138,000 – $153,000. For a married individual filing a separate return, the phase-out range remains at $0 to $10,000. Please keep in mind, if your earned income is less than your eligible contribution amount, your maximum contribution amount equals your earned income.

Larger saver’s credit threshold. The MAGI limit for the saver’s credit (also known as the Retirement Savings Contribution Credit) for low- and moderate-income workers is $73,000 for married couples filing jointly in 2023, $54,750 for heads of household and $36,500 for all other filers.

Be careful of the IRA one rollover rule. Investors are limited to only one rollover from all their IRAs to another in any 12-month period. A second IRA-to-IRA rollover in a single year could result in income tax becoming due on the rollover, a 10% early withdrawal penalty, and a 6% per year excess contributions tax if that rollover remains in the IRA. Individuals can only make one IRA rollover during any 1-year period, but there is no limit on trustee-to-trustee transfers. Multiple trustee-to-trustee transfers between IRAs and conversions from traditional IRAs to Roth IRAs are allowed in the same year. If you are rolling over an IRA or have any questions on IRAs, please call us.

Roth IRA Conversions

In 2023, some IRA owners may want to consider converting part or all of their traditional IRAs to a Roth IRA. This is never a simple or easy decision. Roth IRA conversions can be helpful, but they can also create immediate tax consequences and can bring additional rules and potential penalties. Under the current laws, you can no longer unwind a Roth conversion by re-characterizing it. It is best to run the numbers with a qualified professional and calculate the most appropriate strategy for your situation. Call us if you would like to review your Roth IRA conversion options.

Capital Gains & Losses

Looking at your investment portfolio can reveal several different tax-saving opportunities. Start by reviewing the various sales you have realized so far this year on stocks, bonds, and other investments. Then review what’s left and determine whether these investments have an unrealized gain or loss. (Unrealized means you still own the investment, versus realized, which means you’ve actually sold the investment.)

Know your basis. To determine if you have unrealized gains or losses, you must know the tax basis of your investments, which is usually the cost of the investment when you bought it. However, it gets trickier with investments that allow you to reinvest your dividends and/or capital gain distributions. We will be glad to help you calculate your cost basis.

Consider loss harvesting. If your capital gains are larger than your losses, you might want to do some “loss harvesting.” This means selling certain investments that will generate a loss. You can use an unlimited amount of capital losses to offset capital gains. However, you are limited to only $3,000 ($1,500 if married filing separately) of net capital losses that can offset other income, such as wages, interest, and dividends. Any remaining unused capital losses can be carried forward into future years indefinitely.

Be aware of the “wash sale” rule. If you sell an investment at a loss and then buy it right back, the IRS disallows the deduction. The “wash sale” rule says you must wait at least 30 days before buying back the same security to be able to claim the original loss as a deduction. The deduction is also disallowed if you bought the same security within 30 days before the sale. However, while you cannot immediately buy a substantially identical security to replace the one you sold, you can buy a similar security, perhaps a different stock, in the same sector. This strategy allows you to maintain your general market position while utilizing a tax break.

Always double-check brokerage firm reports. If you sold a security in 2023, the brokerage firm reports the basis on an IRS Form 1099-B in early 2024. Unfortunately, sometimes there could be problems when reporting your information, so we suggest you double-check these numbers to make sure that the basis is calculated correctly and does not result in a higher amount of tax than you need to pay.

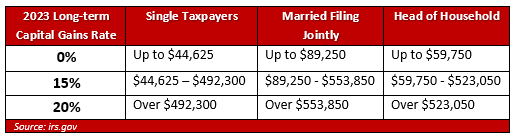

Long-term Capital Gains Tax Rates

Tax rates on long-term capital gains and qualified dividends changed for 2023. You may qualify for a 0% capital gains tax rate for some or all your long-term capital gains realized in 2023. In 2023, the 0% rate applies for individual taxpayers with taxable income up to $44,625 on single returns, $59,750 for head-of-household filers and $89,250 for joint returns. If this is the case, then the strategy is to figure out how much long-term capital gains you might be able to recognize to take advantage of this tax break.

The 3.8% surtax on net investment income stays the same for 2023. It starts for single people with modified AGI over $200,000 and for joint filers with modified AGI over $250,000.

NOTE: The 0%, 15% and 20% long-term capital gains tax rates only apply to “capital assets” (such as marketable securities) held longer than one year. Anything held for one year or less is considered a “short-term capital gain” and those are taxed at ordinary income tax rates.

Some Notable & Continuing Tax Changes for 2023

Some previously itemized deductions are still affected in 2023 under the tax laws. They include:

The floor for deductible medical expenses is still at 7.5%. The 2023 threshold for deducting medical expenses on Schedule A is 7.5% of your 2023 adjusted gross income (AGI). The IRS on IRS.gov provides a long list of expenses that qualify as “medical expenses,” so it can be a good idea to keep keeping track of yours if you think you may qualify.

State and local income, sales, and real and personal property taxes (SALT) are still limited to $10,000.

The deduction for casualty and theft losses is currently allowed only for presidentially declared disaster areas.

Alimony deductions. For divorce and separation instruments executed or modified after December 31, 2018, alimony and separate maintenance payments are not deductible by the payor-spouse, nor includible in the income of the payee-spouse.

Education Planning

Education benefits. The student loan interest deduction, education credits, exclusion for savings bond interest, tuition waivers for graduate students, and the educational assistance fringe benefit are all still available in 2023. 529 plan funds can be used to pay for fees, books, supplies, and equipment for certain apprenticeship programs. In addition, up to $10,000 in total (not annually) can now be withdrawn from 529 plans to pay off student loans.

The 2023 lifetime learning credit allows you to claim 20% of your out-of-pocket costs for tuition, fees, and books, for a total of $2,000 as a tax credit. It phases out for couples filing jointly from $160,000 to $180,000 and from $80,000 to $90,000 for singles.

Charitable Giving

This is a great time of year to clean your garage or house and give your items to charity. Please remember that you can only write off donations to a charitable organization if you itemize your deductions. Sometimes your donations can be difficult to value. You can find estimated values for your donated items through a value guide offered by Goodwill at www.goodwillnne.org/donate/donation-value-guide/

Send cash donations to your favorite charity by December 31, 2023. Be sure to hold on to your canceled check or credit card receipt as proof of your donation. If you contribute $250 or more, you also need a written acknowledgment from the charity. If you plan to make a significant gift to charity this year, consider gifting appreciated stocks or other investments that you have owned for more than one year. Doing so boosts the savings on your tax returns. Your charitable contribution deduction is the fair market value of the securities on the date of the gift, not the amount you paid for the asset and therefore you avoid having to pay taxes on the profit.

Do not donate investments that have lost value. It is best to sell the asset with the loss first and then donate the proceeds, allowing you to take both the charitable contribution deduction and the capital loss. Also remember, if you give appreciated property to charity, the unrealized gain must be long-term capital gains in order for the entire fair market value to be deductible. (The amount of the charitable deduction must be reduced by any unrealized ordinary income, depreciation recapture and/or short-term gain.)

The law allowing taxpayers age 70½ and older to make a Qualified Charitable Distribution (QCD) in the form of a direct transfer of up to $100,000 for individuals directly from their IRA over to a charity, including all or part of the required minimum distribution (RMD) was made permanent in 2015. If you meet the qualifications to utilize this strategy, the funds must come out of your IRA by December 31, 2023. Please call us if this is a strategy you are interested in considering.

Additional Year-end Tax Strategies & Ideas

Make use of the annual gift tax exclusion. You may gift up to $17,000 tax-free to each donee in 2023. These “annual exclusion gifts” do not reduce your $12.92 million lifetime gift tax exemption. This annual exclusion gift is doubled to $34,000 per donee for gifts made by married couples of jointly-held property or when one spouse consents to “gift-splitting” for gifts made by the other spouse.

Help someone with medical or education expenses. There are opportunities to give unlimited tax-free gifts when you pay the provider of the services directly. Medical expenses must meet the definition of deductible medical expenses. Qualified education expenses are tuition, books, fees, and related expenses, but not room and board. You can find the detailed qualifications in IRS Publications 950 and the instructions for IRS Form 709 at www.irs.gov.

Make gifts to trusts. These gifts often qualify as annual exclusion gifts ($17,000 in 2023) if the gift is direct and immediate. A gift that meets all the requirements removes the property from your estate. The annual exclusion gift can be contributed for each beneficiary of a trust. We are happy to review the details with your estate planning attorney.

Estate, Gift, & Generation-Skipping Tax Changes

Exemption amounts for gift, estate, and generation-skipping taxes are another issue that proposals are trying to change. For 2023 the limits are at $12.92 million ($25.84 million for married couples) and the income tax basis step up/down to fair market value at death is in place. Any amount over that is subject to 40% Federal taxes. This high amount provides high-net-worth individuals a significant planning window to make gifts and set up irrevocable trusts.

As a reminder, as of now, in 2026, the estate tax exclusion is due to revert to pre-2018 levels (i.e. 50% of the current exclusion). Adjusted for inflation, we project it will be about $7 million. This is provided by statue and occurs without action by Congress.

In 2019, the Treasury Department and the Internal Revenue Service issued final regulations under IR-2019-189 confirming that individuals who take advantage of the increased gift tax exclusion or portability amounts in effect from 2018 to 2025 will generally not be adversely impacted when TCJA sunsets on January 1, 2026. The best planning practices before the “double” exemption sunsets year-end 2025 are critical to understand as many families face a use-it-or-lose-it problem. For those who have large estates, please call us to discuss your situation.

Looking Ahead to the 2025 Tax Sunset

The Tax Cuts and Jobs Act (TCJA) enacted in 2017 brought many changes to the tax code. This act included provisions for individuals that took effect in 2018 but are currently set to expire after 2025. While this could change, there is a big sense of uncertainty for all taxpayers on what could happen after December 31, 2025. Without any extensions of the TCJA or new changes signed into law, here are five of the key provisions that will revert to their 2017 status.

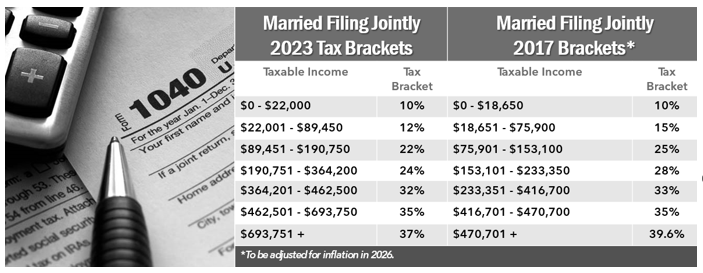

Individual Income Tax Rates: The first piece of knowledge you should know is that the tax rates passed under the Tax Cuts and Jobs Act in 2017 are temporary. If no action is taken before 2026, these tax rates will expire at the end of 2025. In 2026, we will go back to the 2017 tax rates adjusted for inflation. The tax rates we have today are lower and much wider, meaning in many cases, more income is taxed at lower rates when compared to 2017. For planning purposes, given the same level of income, most people could find themselves paying more in taxes in 2026 than in 2023. Although this may be an oversimplification, for illustration purposes, here are the tax brackets in 2023 and 2017 (not including inflation adjustments).

SALT cap is scheduled to disappear. The TCJA eliminated or limited many of the previous laws concerning itemized deductions. An example is the state and local tax deduction (SALT), which is currently capped at $10,000 per year, or $5,000 for a taxpayer filing separately. This cap is set to dissolve after 2025.

Home Equity Line of Credit (HELOC) Interest Deductions: Currently, the deduction limit is $750,000. Starting in 2026, the limitation will revert to $1 million.

Alternative Minimum Tax (AMT): AMT applies to high-income earners. These provisions are set to expire at the end of 2025. The TCJA increased the exemption phaseout threshold, which is currently $578,150 for single filers and $1,156,300 for joint filers. It is set to revert to $120,700 for single filers and $160,900 for married couples.

Changes to Estate Tax Exclusions. As of now, barring any changes, in 2026, the estate tax exclusion is due to revert to pre-2018 levels (adjusted for inflation) which will be approximately $7 million for individuals. Currently, there is a 40% maximum gift and estate tax rate.

Our goal is to keep clients updated when tax laws change so that they can proactively plan. If you’d like to discuss how these sunsetting rules or any tax law changes may affect your situation, please feel free to contact us and we’d be happy to assess your unique financial situation.

Conclusion

One of our primary goals is to keep clients aware of tax law changes and updates. This report is not a substitute for using a tax professional. Please note that many states do not follow the same rules and computations as the federal income tax rules. Make sure you check with your tax preparer to see what tax rates and rules apply for your particular state.

2023 Year-end Tax Planning Checklist

- Bracket Management

- Itemized Deduction Timing

- Gain & Loss Harvesting

- Retirement Planning

- Education Planning

- Charitable Planning

- Gifting Strategies

- Estate Tax Planning

- Planning for Major Financial or Life Events Next Year/Future

- Planning for Any Other Personal Situational Concerns

A “Proactive” approach to your tax planning instead of a “Reactive” approach could produce better results! If you need assistance reviewing any of these items prior to year-end, please call us and we’d be happy to help you!

Complimentary Financial Consultation

We would like to offer you a complimentary consultation with one of our professionals at no cost or obligation to you. You can reach us at our office to schedule your appointment via phone or email at (714) 597-6510 or info@fanwmg.com.

Upcoming Webinars & Classes

- Tax Planning Webinar | Wed, Jan 17 at 6pm

- Retirement Classes | Wed, Thu or Sat – Jan to Feb

- Investments Webinar | Wed, Feb 21 at 6pm

- Property Inheritance Webinar | Wed, Feb 28 at 6pm

- Social Security & Medicare Webinar | Wed, Mar 6 at 6pm

Financial Advisors Network, Inc. is a registered investment advisory firm. Note: The views stated in this letter are not necessarily the opinion of Financial Advisors Network, Inc. and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Please note that statements made in this newsletter may be subject to change depending on any revisions to the tax code or any additional changes in government policy. Please note that individual situations can vary. Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount is subject to its own five-year holding period. Investors should consult a tax advisor before deciding to make a conversion. Rules and laws governing 529 plans are varied and subject to change. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. Investors should consider, before investing, whether the investor’s or the designated beneficiary’s home state offers any tax or other benefits that are only available for investment in such state’s 529 college savings plan. Such benefits include financial aid, scholarship funds, and protection from creditors. The tax implications can vary significantly from state to state. Tax laws and provisions may change at any time. Death of the contributor prior to the end of the five-year period may result in a portion of the contribution being included in the contributor’s estate. Please consult a qualified tax professional to discuss tax matters. Source: irs.gov. Contents provided by the Academy of Preferred Financial Advisors, Inc. Reviewed by Keebler & Associates. © Academy of Preferred Financial Advisors, Inc. 2023.

- Financial Advisors Network Customer Service

- Articles

- Comments Off on Year-end Tax Report