Q2 Newsletter

- 21

- Jul

The second quarter of 2023 tested even the most seasoned of investors. It was a quarter that included the U.S. reaching a debt ceiling agreement, the Federal Reserve pausing their aggressive interest rate hikes, and bank failure fears starting to subside. During the quarter, equity markets continued to defy odds by staying strong, and the major indexes ended the second quarter higher than they started. With the support of mega-cap tech stocks and the artificial intelligence (AI) buzz, the S&P 500 officially began a new bull market in June, rising over 20% from its low in October 2022.

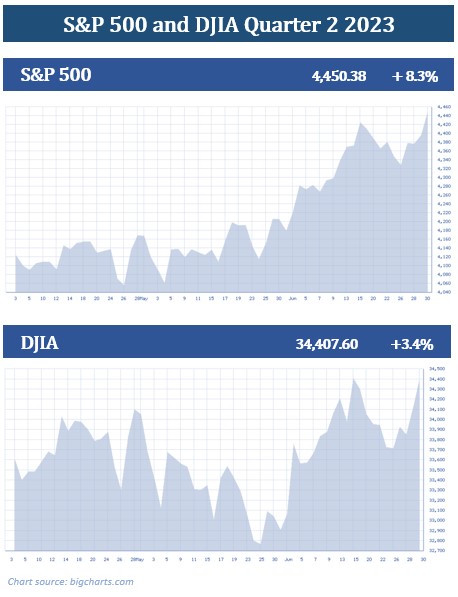

Led by a handful of large tech stocks, the S&P 500 rose 8.3% during the second quarter, logging its third straight quarter gains. The S&P 500 closed the quarter at 4,450, ending the first half of 2023 up 15.9%, for its best half since 2019. The Dow Jones Industrial Average (DJIA) ended the quarter up 3.4%. The DJIA closed on June 30, 2023, at 34,407 (cnbc.com, 6/30/23).

Some experts are arguing that the S&P 500 bull market could be a temporary stroke of luck before an impending recession. The recent rally was fairly concentrated in the big tech sector and did not include many categories like most mid- and small-cap stocks. They suggest that this rally will likely need to broaden its horizons in order to continue.

“This recent bull market move is no guarantee we are out of the woods from the downturn,” Jeremy Siegel, Wharton School Professor and renown economist, said in his commentary piece for WisdomTree. “I remain cautious, and I do not think we have the start of a major up move here,” he added.

However, other experts, like Tom Lee, Head of Research for Fundstrat, believe that stocks are not extended and that big tech, “did the heavy lifting.” He also shared, “if we are slipping into an expansion, a lot of other groups are going to participate” (markets.businessinsider.com, 6/17/23).

While we can speculate and deliberate on what the economy will do, no one has predictive powers and, as the last few years have shown us, anything can happen. What investors do know is that uncertainty remains a key theme. It was just over a year ago that you could borrow at historically low, near zero percent rates. In January 2021, the inflation rate was at only 1.4%. Since then, the cost of necessities and living expenses has increased significantly. For example, the average price of a loaf of white bread has increased 23.19% since 2020 (www.in2013dollars.com).

During the quarter, investors faced the possibility that the U.S. was on the verge of a major default. We breathed a huge sigh of relief with the debt ceiling agreement, which staved off a potentially catastrophic crisis for the U.S. economy. On June 1, the Senate passed a measure suspending the nation’s debt ceiling and putting caps on federal spending until January 2025. Some key changes that come from debt ceiling deal are:

- A reduction in direct spending on domestic programs (this does not include Social Security or Medicare).

- A reduction in IRS funding. In 2022, as part of the Inflation Reduction Action, Congress approved $80 billion for the expansion of the IRS. This new bill pared that number back to reallocate the funds for other areas.

- A small increase in spending (a maximum of 1% on 2025) for military and veteran affairs.

- Claw backs of unused COVID-19 funding.

- Expedition of large energy and infrastructure projects.

After the debt ceiling deal, equity markets remained positive and historically, on average, U.S. stock markets have risen in the months following an agreement to raise the debt ceiling.

Although the second quarter was kind to investors, this is not the time to become complacent. With political pressures and continuing changes in monetary and fiscal policy, equity market volatility could remain very prevalent.

Global issues, including the continuation of the war in Ukraine and the strained China/U.S. relationships could also generate additional uncertainties for investors.

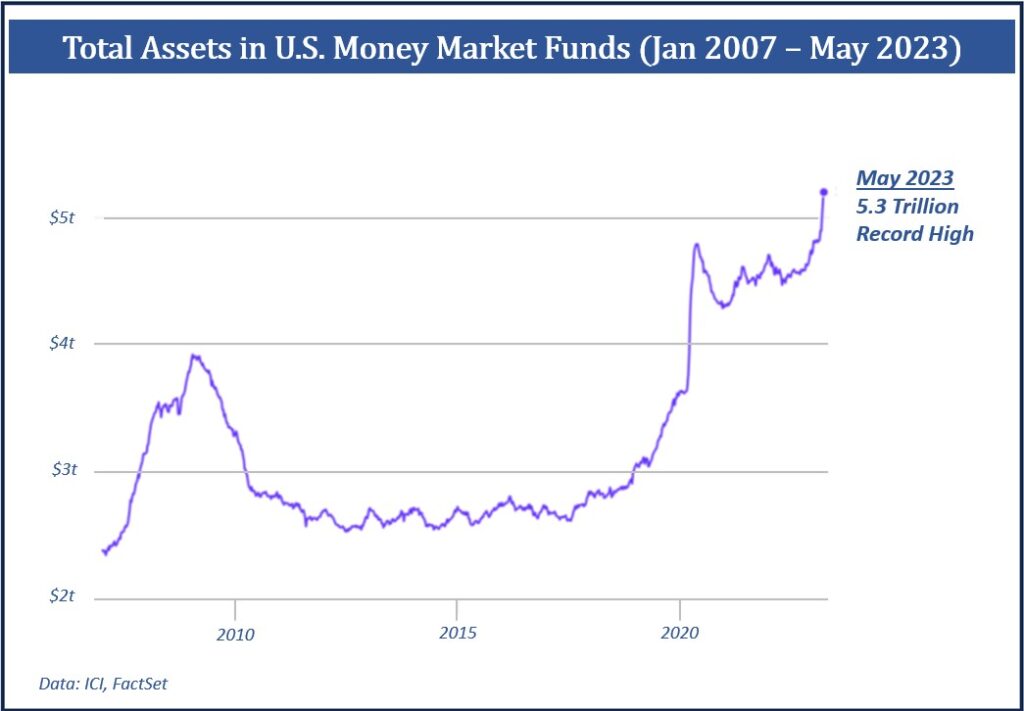

Right now, the saying “cash is king” is resonating with many Americans. Market volatility has spooked many investors into a cash-dominant position. Cash levels are at an all-time high. As of May, money market assets are the highest they have been in decades. This makes guessing about market moves even more difficult. While there is a high amount of cash on the sidelines currently, that could change and affect equity pricing. With this, investors should not try to out-guess what the markets will do.

This is a time to concentrate on your personal financial plan. Having a long-term-focused plan that is well diversified can help position you to manage volatility in the markets. We are available to review our clients’ investments and make sure they are still congruent with your time horizon, risk tolerance, and goals.

We continue to abide by our belief that investing is a long-term commitment and can provide a better safety net than short-term trading and investing.

As your financial professional, we are committed to keeping you apprised of any changes and activity that could directly affect you and your unique situation.

Inflation & Interest Rates

In the second quarter, we saw some easing of inflation numbers. In May 2023, prices increased by 4% compared to 8.6% in May 2022 according to the 12-month percentage change in the consumer price index (CPI) (statista.com, 6/19/23).

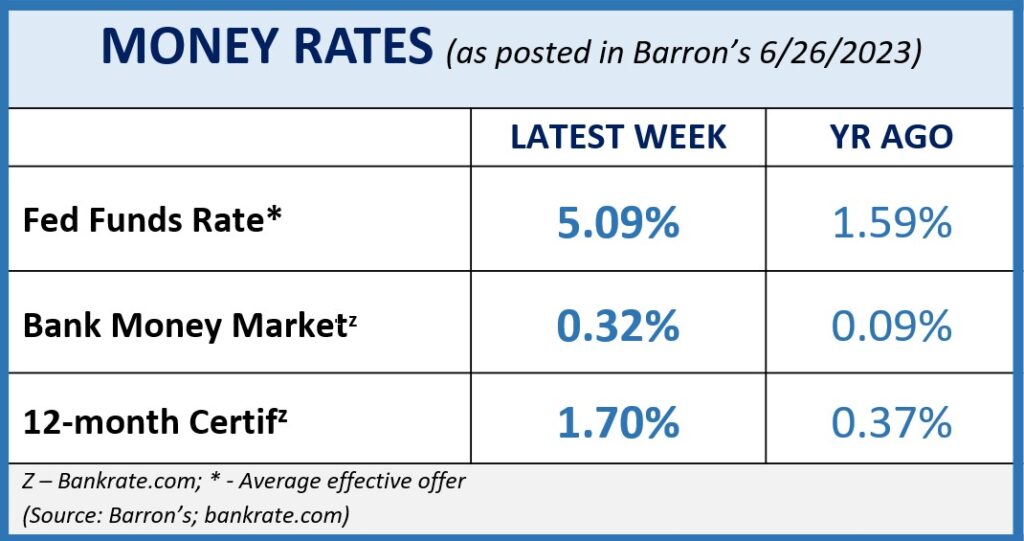

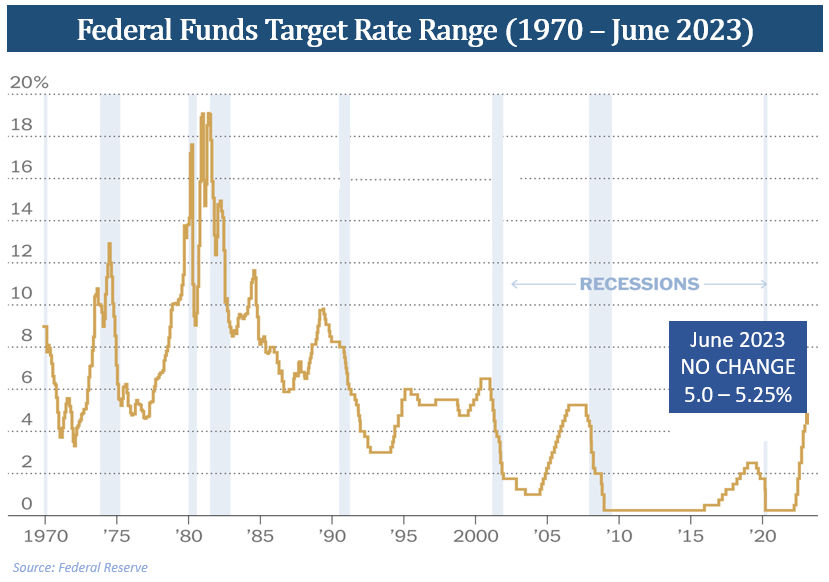

In response to the slowing of inflation, after 10 consecutive interest rate hikes, the Fed took a much-anticipated pause in June. As of June, the Federal Funds target rate range is 5.0 – 5.25%.

The bad news is that the Fed’s made it very clear that future hikes are still a high probability. While inflation is more moderate than it was 12 months ago, it is still being relentless and inflation pressures continue to put a strain on the economy. Speaking to the Senate Committee in mid-June, Chairperson Jerome Powell repeated that interest rate hikes are likely to continue at least one more time, if not two, in 2023, indicating that we could see another half percentage point of increases through the end of 2023.

“If you look at the data over the last quarter, what you see is stronger than expected growth, a tighter than expected labor market, and higher than expected inflation,” said Chair Powell. He continued, “So that tells us that although policy is restrictive, it may not be restrictive enough and it has not been restricted for long enough” (finance.yahoo.com 6/28/23).

Powell stated that, “We believe there’s more restriction coming” due to a “very strong labor market.” (cnbc.com, 6/28/23),

The Fed will continue to work toward its’ 2% inflation rate goal and there are four more FOMC meetings in 2023, in July, September, Oct/Nov, and December. “It’s going to take some time. Inflation has proven to be more persistent than we expected and not less,” Powell said. “Of course, if that day comes when that turns around, that’ll be great. But we don’t expect that.” (cnbc.com, 6/28/23).

Investors seeking returns from Certificate of Deposits (CDs) and even saving accounts are currently benefiting from the higher interest rate environment. For almost a decade there was very little return on these types of investments, but now, it is not unusual to see some banks offering CDs with yields over 4%.

Like all aspects of financial planning that may affect you, we are keeping a vigilant eye on interest rates and inflation. If you’d like to know how these may affect your portfolio, please contact us to discuss any strategies that may help combat the effect on your personal situation. While we cannot predict what the Fed’s next move will be, we are keeping a watching eye on key economic indicators, such as the CPI.

The Bond Market & Treasury Yields

In early 2022, most treasuries yielded at near-record lows. In contrast, today an investor can now get some interest from bond yields. Earlier in 2023, there were a few bank failures, which drove investors to treasuries in very large numbers.

All in all, the second quarter of 2023 was mixed for bonds. While treasuries are yielding favorable returns in this high interest rate environment, if in the future the Fed decides to ease up or reverse interest rates, that would narrow the opportunity to get lower-risk, higher-yielding bonds quickly. For right now, the Fed has signaled potentially more interest rate hikes, meaning higher short-term rates could remain at or above current levels.

As of June 30, 5-year treasury notes yielded 4.13%, 10-year notes yielded 3.81%, 20-year notes yielded 4.06%, and 30-year notes reached 3.85%.

Traditionally, longer-term bonds have higher yields than shorter-term bonds, but this is not always the case. Since April of 2022, we have experienced an inverted yield curve, which means longer maturities provide a lower yield than some shorter maturities. Some analysts share that their research indicates that historically this is a strong indicator that a recession is pending in the next several months. Keep in mind that there are other factors that should be considered, including job reports, wage growth, and inflation before determining if a recession is imminent or even coming.

If you’d like to explore how bonds could fit into your retirement income strategy, please contact us so we can help you make the best decision for your portfolio. Please remember, while diversification in your portfolio can help you pursue your goals, it does not ensure a profit or guarantee against loss.

We will continue to monitor how the Fed’s movements and how rising interest rates are affecting bond yields.

Investor’s Outlook

There is much talk in financial circles about the possibility that the U.S. will experience a recession in 2023. According to the New York Fed, the U.S. has a 70% chance of falling into a recession by May of 2024. Obviously, no one can completely tell for sure if this will happen, and if so, at what level of severity (markets.businessinsider.com, 6/17/23).

When asked about the possibility of a recession during the monetary policy session in Portugal in June, Chair Powell stated that, “There’s a significant possibility that there will be a downturn,” Powell said, adding that it’s not, “the most likely case, but it’s certainly possible” (cnbc.com, 6/28/23).

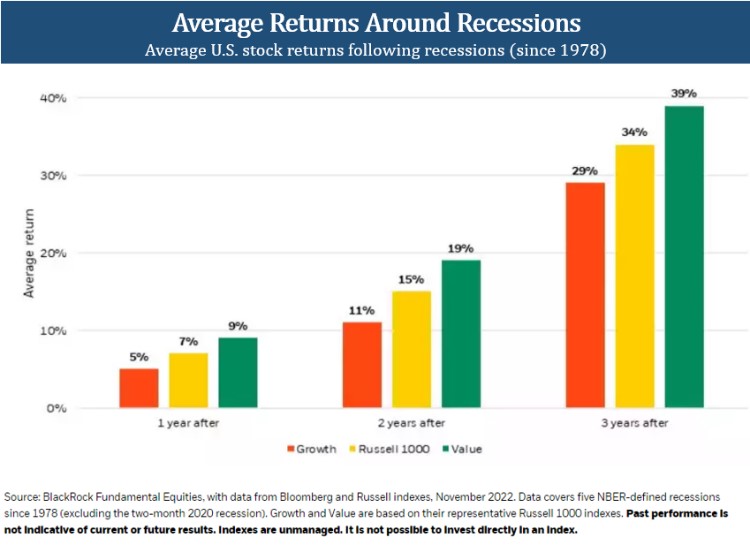

As a reminder, like downturns, recessions are not new concepts. The S&P 500 has weathered 17 recessions in the last century and never failed to recoup its losses. Please keep in mind that the S&P 500 historically starts to rebound before the end of a recession, which makes market timing a poor investment strategy.

The National Data of Economic Research (NBER) recorded that the average S&P 500 recovery is almost +40% in the 18 months following the market bottom during the recession. For example, the recession we experienced from December 2007 – June 2009, when the GDP went down 5.10%, the S&P 500 rebounded, performing at 14.4% after 12 months, 57.70% in the third year following, at 137% in the fifth year following (www.nber.org).

Instead of trying to predict whether a recession may happen, we suggest you proactively plan to ensure you have your financial plan set up to best weather anything the economy may throw at you. The past few years have taught investors that it’s better practice to expect the unexpected.

Should the U.S. experience a recession, it is wise that you remain financially liquid. This means that you should make sure you can meet your financial obligations. You should also anticipate any large cash commitments you foresee, such as funding a wedding, purchasing a home, or buying a recreational vehicle.

There is a strong possibility that the Fed will increase rates by a half percent by the end of 2023. Many analysts are suggesting it will be done with two-quarter point increases in the second half of 2023. Obviously, this will depend on the data the Fed receives. Current reports are sharing that we are past the inflation peak and closer to the end of the Fed hiking cycle but do not be surprised by a few more rate hikes. Heading into the third quarter, we will continue to keep an eye on inflation rates, economic growth data, and monetary policy moves. Since the conclusion of the debt crisis, we are hopeful that this upcoming quarter brings less surprises and cliffhangers.

Our goal as your financial professional is to not try to predict the future but provide you with a solid financial plan that is designed to best weather any market environment. While past performance is not a guarantee of current or future results, history shows us that returns from equities after a recession have been fruitful.

We stand by our belief that investing in equities is a long-term commitment. Investors can expect to continue to face a challenging market environment and the need to look at long-term stability and quality, practicing patience, and proceeding with caution are key to your financial success.

We know that loss aversion can be a powerful motivator for investors to back out of equities during uncertain times. Please remember, historically, investors with a long-term plan that stayed the course and remained diversified and invested were rewarded. We believe this still holds true for today’s investors. Savvy investors have a long-term mindset and have well-devised and diversified financial plans.

The coming months could be filled with uncertainty and more market volatility. A few tips to help you through uncertain times are:

- Keep your head down and do not make decisions based solely on what you hear from the media. It seems like from many sources the news is no longer there to inform the viewer, but rather to incite fear in the viewer. Media magnification can cause anxiety and even cause investors to make emotionally charged decisions, which typically are not the wisest.

- It is always sound judgment to live within your means and to not incur any more debt than necessary. During uncertain economic times and higher interest rate environment, it is even more wise to pay down your debt and try not to incur any more.

- If possible, continue to add to your savings. Staying consistent with contributions will help you achieve your savings goals. There are currently reasonable returns on many Certificates of Deposits (CDs) and savings accounts. If you’d like to discuss if these are good options for your situation, please call us.

- If you need to, review your financial plan with us.

Our goal as the steward of your wealth is to help you through uncertain times like these. We always attempt to help you create a well-crafted plan customized for your unique situation and goals that takes into consideration how you will react to the equity markets ups and downs, including your time horizon, tax implications, liquidity needs, risk tolerance, and your overall personal objectives.

We take pride on offering our clients first-class service that includes:

- A proactive, individually tailored approach to each client’s financial goals and needs.

- Consistent and meaningful communication throughout the year.

- A schedule of regular client meetings.

- Continuing education for all our team members on issues that may affect our clients.

- Proactive planning to navigate the changing environment.

We always recommend discussing with us any changes, concerns, or ideas that you may have prior to making any financial decisions so we can help you determine your best strategy. There are often other factors to consider, including tax ramifications, increased risk, and time horizon changes when altering anything in your financial plan.

Please remember, we are accessible to you! Feel free to contact us with any concerns or questions you may have.

We appreciate the trust and confidence you place in our firm.

Team Accomplishment

Financial Advisors Network, Inc. is a registered investment advisory firm. Advisory services are only offered to clients or prospective clients where Financial Advisors Network, Inc. and its representatives are property licensed or exempt for licensure. No advice may be rendered by Financial Advisors Network, Inc. unless a client service agreement is in place. The views stated in this letter are not necessarily the opinion of Financial Advisors Network, Inc. and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 1000 Index consists of the 1,000 largest securities in the Russell 3000 Index, which represents approximately 90% of the total market capitalization of the Russell 3000 Index. It is a large-cap, market-oriented index and is highly correlated with the S&P 500 Index. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk. Sources: www.cnbc.com; www.statista.com; www.barrons.com; www.markets.businessinsider.com; www.in2013dollars.com; www.finance.yahoo.com; www.blackrock.com; www.awealthofcommonsense.com; www.currentmarketvaluation.cpm; Contents provided by the Academy of Preferred Financial Advisors, 2023©

- Financial Advisors Network Customer Service

- Articles

- Comments Off on Q2 Newsletter