Q1 Tax Report

- 14

- Feb

Helpful Information for Filing 2023 Income Taxes & Proactive Tax Planning for 2024

Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to identify as many tax saving opportunities and strategies as possible for our clients. We believe that a proactive approach to looking at your tax situation can lead to better results than a reactive approach. We hope you find this report helpful.

This special report reviews some of the broader tax laws along with a wide range of tax reduction strategies. As you read this report, please take note of each tax strategy that you think could be beneficial to you. Not all ideas are appropriate for all taxpayers. We always recommend that you address any tax strategy with your tax professional to consider how one strategy may affect another and calculate the income tax consequences (both state and federal). Remember, tax strategies and ideas that have worked in the recent past might not even be available under today’s new tax laws. Always attempt to understand all the details before making any decisions—it is always easier to avoid a problem than it is to solve one.

Please note: Your state income tax laws could be different from federal income tax laws. Visit https://tax.findlaw.com for a wide range of information and links to tax forms for all 50 states. All examples mentioned in this report are hypothetical and meant for illustrative purposes only.

Tax laws always seem to be changing. Most of the Tax Cuts and Jobs Act (TCJA) changes are scheduled to expire on December 31, 2025. Are you aware of how this may affect you? Please contact our office for information on these sunsetting tax laws.

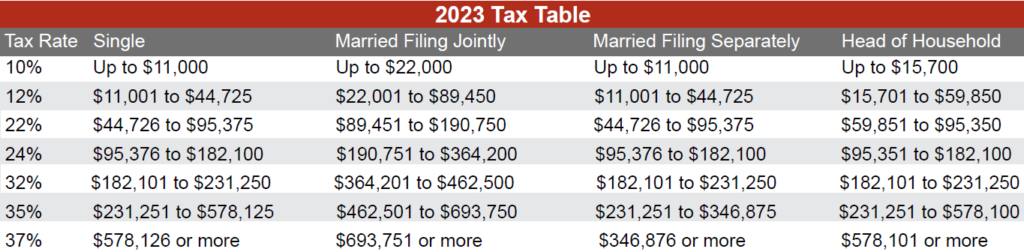

Income tax is a large revenue source for the United States government. While tax rates have changed many times, since the 1860’s, the United States has used a “progressive” tax code. A progressive tax code means that people who make more money are taxed at a higher rate than those who make less money. Our progressive tax system works by placing earners through different brackets according to how much money they make. The dollar amounts define your tax brackets and there are differing tables depending on your filing status (single, married, etc.). This matters in determining your marginal tax rate.

Understanding Marginal Tax Rates

Determining your tax bracket is not as simple as just adding up your total income and checking a tax table. Taxpayers need to calculate their income (which can be sometimes referred to as their “adjusted gross income”) and then adjust for any deductions to find their final taxable amount.

Once you determine your taxable income amount, it is critical to know that your income will be taxed at different rates. For example, if someone is married filing jointly in 2023 with $95,000 of taxable income, their first $22,000 is taxed at 10%, the $67,450 at 12%, and $5,550 at 22%. An important concept to understand is that these same tax filers are in a “marginal tax bracket” of 22%. That is, their last dollar earned is taxed at that 22% tax rate.

2023 Tax Law Updates

2023 brought some tax legislation changes. While there is time to investigate tax planning ideas for your 2024 taxes, here are some items that 2023 tax filers should review.

- Tax brackets have been slightly adjusted.

- Standard deductions have slightly increased.

- The cap on state and local tax (SALT) deductions remains.

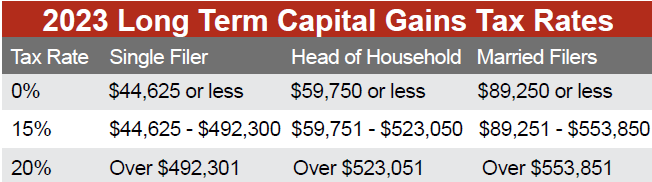

- Long-term capital gains are still taxed at favorable rates.

- There is still a 3.8% Net Investment Tax.

- Charitable donations are available to those who can itemize deductions.

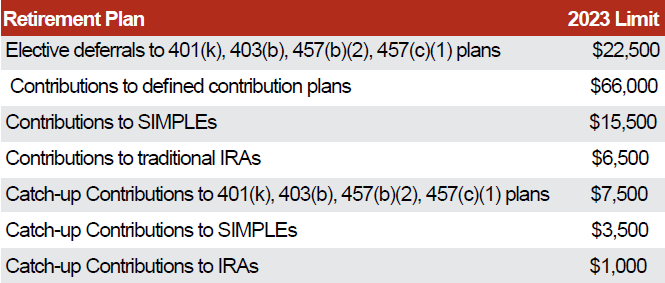

- You might still be able to contribute to retirement plans.

- Medical expense deductions are capped at 7.5% of AGI for 2023.

2023 Tax Tables & Tax Rates

There are still seven federal income tax brackets for 2023. The lowest of the seven tax rates is 10% and the top tax rate is still 37%. The income that falls into each is scheduled to be adjusted in 2024 for inflation. For 2023, use the chart in this report to see what bracket your final income falls into.

TAX TIP: If you are not sure how best to file, ask your tax preparer or review IRS Publication 17, Your Federal Income Tax, which is a complete tax resource. It contains helpful information such as whether you need to file a tax return and how to choose your filing status.

2023 Standard Deduction Amounts

Most taxpayers claim the standard deduction. For 2023, the standard deduction has slightly increased. The amounts are now $13,850 for single filers and $27,700 for those filing jointly ($20,800 for head of household filers). If you are filing as a married couple, an additional $1,500 is added to the standard deduction for each spouse age 65 and older or blind. If you are single, an additional deduction of $1,850 can be made.

Increased Child Tax Credit

The American Rescue Plan Act (ARPA) extended the increased Child Tax Credit (CTC) for the tax year of 2021 only. For 2021, the child tax credit for children under 6 years old was $3,600, and for children 6-17, it was $3,000. Starting in 2022, the credit reverted back to the rules in the Tax Cuts and Jobs Act (TCJA), with a maximum tax credit of $2,000 for each qualifying child.

State & Local Tax (SALT) Deduction

Under the 2017 Tax Cuts and Jobs Act (TCJA) state and local tax deductions (SALT) remain capped at a combined total of $10,000 (or $5,000 for married taxpayers filing separately). This deduction limitation is set to sunset at the end of 2025.

Medical Expense Deduction

The 2023 threshold for deducting medical expenses remains 7.5% of your AGI. You must itemize your deductions to deduct these medical expenses. The IRS website, www.IRS.gov, provides a long list of expenses that qualify as “medical expenses” so it can be a good idea to keep track of yours if you think they may qualify.

Investment Income

Long-term capital gains are taxed at more favorable rates compared to ordinary income. For qualified dividends, investors will continue to be taxed at 0, 15% or 20%.

One tax strategy is to review your investments that have unrealized long-term capital gains and sell enough of the appreciated investments to generate enough long-term capital gains to push you to the top of your federal income tax bracket. This strategy could be helpful if you are in the 0% capital gains bracket and do not have to pay any federal taxes on this gain. Then, if you want, you can buy back your investment the same day, increasing your cost basis in those investments. If you sell them in the future, the increased cost basis will help reduce long-term capital gains. You do not have to wait 30 days before you buy back this investment—the 30-day rule only applies to losses, not gains.

Note: This non-taxable capital gain for federal income taxes might not apply to your state.

TAX TIP: Remember that marginal tax rates on long-term capital gains and dividends can be higher than expected. The 3.8% surtax can raise the effective rate to 18.8% for single filers with income from $200,000 to $492,300 and 23.8% for single filers with income above $492,300 in 2023. It can raise the effective rate to 18.8% for married taxpayers filing jointly with income from $250,000 to $553,850 and to 23.8% for married taxpayers filing jointly with income above $553,850.

Calculating Capital Gains & Losses

With the different tax rates for different types of gains and losses in your marketable securities portfolio, it is probably a good idea to familiarize yourself with some of the ordering rules:

- Short-term capital losses must first offset short-term capital gains.

- Long-term capital losses must first offset long-term capital gains.

- If there are net short-term losses, they can be used to offset net long-term capital gains.

- If there are net long-term losses, they can be used to offset net short-term capital gains.

- If all gains and losses net to an overall loss, up to $3,000 can offset ($1,500 if married filing separately) ordinary income.

- Remaining unused capital losses can be carried forward to later tax years and then considered in the same manner as described above.

TAX TIP: Please remember to look at your 2022 income tax return Schedule D (page 2) to see if you have any capital loss carryover for 2023. This is often overlooked, especially if you are changing tax preparers.

Please double-check your capital gains or losses. If you sold an asset outside of a qualified account during 2023, you most likely incurred a capital gain or loss. Sales of securities showing the transaction date and sale price are listed on the 1099 generated by the financial institution. However, your 1099 might not show the correct cost basis or realized gain or loss for each sale. You will need to know the full cost basis for each investment sold outside of your qualified accounts, which is usually what you paid for it, but this is not always the case.

3.8% Medicare Investment Tax

The year 2023 is the eleventh year of the net investment income tax of 3.8%. It is also known as the Medicare surtax. If you earn more than $200,000 as a single or head of household taxpayer, $125,000 as married taxpayers filing separately or $250,000 as married joint return filers, then this tax applies to either your modified adjusted gross income or net investment income (including interest, dividends, capital gains, rentals, and royalty income), whichever is lower. This 3.8% tax is in addition to capital gains or any other tax you already pay on investment income.

It is helpful to pay attention to timing, especially if your income fluctuates from year to year or is close to the $200,000 or $250,000 amount. Consider realizing capital gains in years when you are under these limits. The inclusion limits may penalize married couples, so realizing investment gains before you tie the knot may help in some circumstances. This tax makes the use of depreciation, installment sales, and other tax deferment strategies suddenly more attractive.

Medicare Health Insurance Tax on Wages

If you earn more than $200,000 in wages, compensation, and self-employment income ($250,000 if filing jointly, or $125,000 if married and filing separately), the Affordable Care Act levies a special additional 0.9% tax on your wages and other earned income. You’ll pay this all year as your employer withholds the additional Medicare Tax from your paycheck. If you’re self-employed, plan for this tax when you calculate your estimated taxes.

If you’re employed, there’s little you can do to reduce the bite of this tax. Requesting non-cash benefits in lieu of wages won’t help—they’re included in the taxable amount. If you’re self-employed, you may want to take special care in timing income and expenses (especially depreciation) to avoid the limit.

Charitable Gifts & Donations

In 2023, the rules return to the previous requirements that taxpayers can only deduct charitable contributions if they itemize their tax deductions on Schedule A. Through 2025, the 60% of AGI ceiling on charitable cash contributions remains unchanged but is scheduled to revert to 50% thereafter.

To qualify for the 60% limitation, the charitable gift must be cash (or cash equivalent) made to a qualified charity (501(c)(3)). To qualify, this contribution should have been made on or before December 31, 2023.

When preparing your list of charitable gifts, remember to review your bank account so you do not leave any out. Everyone remembers to count the monetary gifts they make to their favorite charities, but you should count noncash donations as well. Make it a priority to always get a receipt for every gift. Keep your receipts. If your contribution totals more than $250, you will also need an acknowledgement from the charity documenting the support you provided. Remember that you will have to itemize to claim this deduction, but when filing, the expenses incurred while doing charitable work often are not included on tax returns.

You can’t deduct the value of your time spent volunteering, but if you buy supplies for a group, the cost of that material is deductible as an itemized charitable donation. You can also claim a charitable deduction for the use of your vehicle for charitable purposes, such as delivering meals to the homebound in your community or taking your child’s Scout troop on an outing. For 2023, the IRS will let you deduct that travel at .14 cents per mile.

Child & Dependent Care Credit

Millions of parents claim the child and dependent care credit each year to help cover the costs of after-school daycare while working. Some parents overlook claiming the tax credit for childcare costs during the summer. This tax break can also apply to summer day camp costs. The key is that for deduction purposes, the camp can only be a day camp, not an overnight camp.

In 2023, if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 17 or a disabled dependent of any age, depending on your income you may qualify for a tax credit of up to 50% of qualifying expenses of $2,000 for one child or dependent, or up to $6,000 for two or more children.

Contribute to Retirement Accounts

The SECURE Act allowed people with earned income to make contributions to Traditional IRAs past the age of 70½ starting in 2020.

If you have not already funded your retirement account for 2023, consider doing so by Monday, April 15, 2024. That’s the deadline for contributions to a traditional IRA (deductible or not) and a Roth IRA. However, if you have a Keogh or SEP and you get a filing extension by October 15, 2024, you can wait until then to put 2023 contributions into those accounts. To start tax-advantaged growth potential as quickly as possible, however, try not to delay in making contributions. If eligible, a deductible contribution will help you lower your tax bill for 2023 and your contributions can grow tax deferred.

To qualify for the full annual IRA deduction in 2023, you must either: 1) not be eligible to participate in a company retirement plan, or 2) if you are eligible, there is a phase-out from $73,000 to $83,000 of MAGI for singles and from $116,000 to $136,000 for married taxpayers filing jointly. If you are not eligible for a company plan but your spouse is, your traditional IRA contribution deduction is phased out from $218,000 to $228,000. For 2023, the maximum IRA contribution you can make is $6,500 ($7,500 if you are age 50 or older by the end of the calendar year). For self-employed persons, the maximum annual addition to SEPs and Keoghs for 2023 is $66,000.

Although contributing to a Roth IRA instead of a traditional IRA will not reduce your 2023 tax bill (Roth contributions are not deductible), it could be the better choice because all qualified withdrawals from a Roth can be tax-free in retirement. Withdrawals from a traditional IRA are fully taxable in retirement. To contribute the full $6,500 ($7,500 if you are age 50 or older by the end of 2023) to a Roth IRA, you must have MAGI of $138,000 or less a year if you are single or $218,000 if you are married and file a joint return. If you have any questions on retirement contributions, please call us.

Roth IRA Conversions

A Roth IRA conversion is when you convert part or all of your traditional IRA into a Roth IRA. This is a taxable event. The amount you converted is subject to ordinary income tax. It might also cause your income to increase, thereby subjecting you to the Medicare surtax. Roth IRAs grow tax-free and qualified withdrawals are tax-free in the future, a time when tax rates might be higher.

Whether to convert part or all of your traditional IRA to a Roth IRA depends on your particular situation. It is best to prepare a tax projection and calculate the appropriate amount to convert. Remember—you do not have to convert all of your IRA to a Roth. Roth IRA conversions are not subject to the pre-age 59½ penalty of 10%.

Many 401(k) plan participants (if their plan allows) can convert the pre-tax money in their 401(k) plan to a Roth 401(k) plan without leaving the job or reaching age 59½. There are numerous pros and cons to making this change. Please call us to see if this makes sense for you.

Required Minimum Distributions (RMD)

The SECURE Act increased the age for Required Minimum Distributions (RMD) starting January 1, 2020, to age 72. The most recent SECURE 2.0 Act increased the age to start taking RMDs further, to 73 in 2023 and to 75 in 2033.

The purposes of tax year 2023, the Required Minimum Distributions age is 73.

Other Overlooked Tax Items & Deductions

Reinvested Dividends – This is not a tax deduction, but it is an important calculation that can save investors a bundle. Former IRS commissioner Fred Goldberg told Kiplinger magazine for their annual overlooked deduction article that missing this break costs millions of taxpayers a lot in overpaid taxes.

Many investors have mutual fund dividends that are automatically used to buy extra shares. Remember that each reinvestment increases your tax basis in that fund. That will, in turn, reduce the taxable capital gain (or increases the tax-saving loss) when you redeem shares. Please keep good records. Forgetting to include reinvested dividends in your basis results in double taxation of the dividends—once in the year when they were paid out and immediately reinvested and later when they are included in the proceeds of the sale.

If you are not sure what your basis is, ask the fund or us for help. Funds often report to investors the tax basis of shares redeemed during the year. Regulators currently require that for the sale of shares purchased, financial institutions must report the basis to investors and to the IRS.

Student-Loan Interest Paid by Parents – Generally, you can deduct interest only if you are legally required to repay the debt. But if parents pay back a child’s student loans, the IRS treats the transactions as if the money were given to the child, who then paid the debt. So as long as the child is no longer claimed as a dependent, the child can deduct up to $2,500 of student-loan interest paid by their parents each year and is subject to income limitations. (The parents can’t claim the interest deduction even though they actually foot the bill because they are not liable for the debt).

Helpful Tax TIme Strategies

- Write down expenses or keep all receipts you think are even possibly tax-deductible. Sometimes, taxpayers assume that various expenses are not deductible and therefore do not mention them to their tax preparer. Don’t assume anything—give your tax preparer the chance to tell you whether something is or is not deductible.

- Be careful not to overpay Social Security taxes. If you received a paycheck from two or more employers and earned more than $160,200 in 2023 you may be able to file a claim on your return for the excess Social Security tax withholding.

- Don’t forget items carried over from prior years because you exceeded annual limits, such as capital losses, passive losses, charitable contributions, and alternative minimum tax credits.

- Check your 2022 tax return to see if there was a refund from 2022 applied to 2023 estimated taxes.

- Calculate your estimated tax payments for 2024 very carefully. Many computer tax programs will automatically assume that your income tax liability for the current year is the same as the prior year. This is done to avoid paying penalties for underpayment of estimated income taxes. However, in some cases this might not be a correct assumption, especially if 2023 was an unusual income tax year due to the sale of a business, unusual capital gains, the exercise of stock options, or even winning the lottery! A qualified tax professional should be able to help you with a tax projection for 2024.

- Remember that IRS.gov could be a valuable online resource for tax information.

- Always double-check your math where possible and remember it is always wise to consult a tax preparer before filing.

Proactive Tax Planning for 2024

Proactive Tax Planning

A “Proactive” approach to your tax planning instead of a “Reactive” approach could produce better results!

Items Taxpayers Could Consider to Proactively Tax Plan for 2024 Include:

- Prepare a 2024 tax projection – Taxpayers already know the 2024 rates and by reviewing their 2023 situation and all 2024 expectations of income, a qualified tax professional could be able to help you with a tax projection for 2024.

- New contribution limits for retirement savings – For 2024, the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $23,000. The limit on annual contributions to an IRA also increases to $7,000. The catch-up contribution limits for those 50 and over remain unchanged at $1,000 for IRAs.

- Explore if a potential Roth IRA conversion is helpful for your situation – A Roth IRA can be beneficial in your overall retirement planning. Investments in a Roth IRA have the potential to grow tax-free and they do not have required minimum distributions during the lifetime of the original owner. Also, Roth IRA assets may pass to your heirs income tax-free. Roth conversions include complex details and are not right for everyone. Also, some recent proposals have suggested changes about which IRAs could be converted to ROTH IRAs. For updates and to review if a ROTH conversion is a good idea for you, please call us.

- Take advantage of annual exclusion gifts –For 2024, the maximum amount of gift tax exemption is $18,000 for gifts made by an individual, and $36,000 for gifts made by married couples. This means you can give up to that amount to a family member without having to pay a gift tax. Ideas for gifting can include, contributing to a working child (or grandchild’s) IRA, or gifting to a 529 plan, which is a tax-sheltered plan for college expenses.

- Consider bunching your charitable donations into a Donor Advised Fund (DAF) – Now is the time to explore if it is helpful for your tax situation to deposit cash, appreciated securities or other assets in a Donor Advised Fund, and then distributing the money to charities over time. Up to 60% of your adjusted gross income can be deductible if given as donations to typical charities.

- Talk with us about your situation. As financial professionals, we enjoy helping clients pursue their goals. We appreciate the opportunity to be the stewards of our client’s wealth.

The 2025 Sunset of Tax Cuts & Jobs Act Provisions

Upcoming Tax Changes You Should Know

The Tax Cuts and Jobs Act (TCJA) bill was signed into law in December of 2017. Most of the changes that were made in this bill are scheduled to expire on December 31, 2025. Congress could extend some or all the provisions beyond 2025, but as of now, the sunsetting of these changes is still intact.

- At the end of 2025, the individual tax rates are currently scheduled to go back to 2017 levels. The top tax rate will be going up to 39.6 from 37%.

- Standard deductions are scheduled to be cut in half at the end of 2025. For example, the standard deduction for those married filing jointly might be $30,000 in 2025 but reduced to $15,500 in 2026 (the extra $500 is an inflation adjustment).

- Pass-through deductions are going away at the end of 2025. Right now, most pass-through businesses (i.e. partnerships or S Corps) can take a 20% deduction off their income immediately before it passes through to their individual tax return.

- Estate tax exemptions are scheduled to be cut significantly by the end of 2025. For those whose estates have built up assets, their estate taxes could be substantially different unless they do something before December 31, 2025.

- State and local tax deductions will no longer be capped at $10,000. Taxpayers will be allowed to use State and local tax deductions to the extent their tax situation allows.

We believe in a proactive approach to your finances.

If you are curious about how the sunset of these tax laws could affect your situation, please call us to explore this topic further.

Conclusion

Filing your 2023 taxes will continue to include the new tax rates set forth with the Tax Cuts and Jobs Act (TCJA) enacted in 2018 (currently set to expire after 2025). An essential part of maintaining your overall financial health is attempting to keep your tax liability to a minimum.

One of our primary goals is to keep you informed of the changes that will be affecting investors like you. We believe that taking a proactive approach is better than a reactive approach—especially regarding income tax strategies!

Remember — If you ever have any questions regarding your finances, please call us first before making any decisions. We pride ourselves in our ability to help clients make informed decisions.

We’re here to help you! We don’t want you to worry about things that you don’t need to worry about!

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Upcoming Events

- Investments Webinar | Wed, Feb 21 at 6pm

- Property Inheritance Webinar | Wed, Feb 28 at 6pm

- Social Security & Medicare Webinar | Wed, Mar 6 at 6pm

- Saturday Retirement Class at FAN | 2/24 & 3/2 from 8:30am to 1pm

Financial Advisors Network, Inc. is a registered investment advisory firm. The views stated in this letter are not necessarily the opinion of Financial Advisors Network, Inc.and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Please note that statements made in this newsletter may be subject to change depending on any revisions to the tax code or any additional changes in government policy. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax. The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax-free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. Additionally, each converted amount is subject to its own five-year holding period. Investors should consult a tax advisor before deciding to make a conversion. Sources: www.IRS.gov, turbotax.com; Investopedia.com. Contents Provided by The Academy of Preferred Financial Advisors, Inc 2024© All rights reserved. Reviewed by Keebler & Associates.

- Macaela Fahey

- Uncategorized

- Comments Off on Q1 Tax Report