.jpg)

Decoding the One Big Beautiful Bill Act

On July 4, 2025, President Trump signed a new bill that will change financial planning for millions of Americans. Referred toas the “One Big Beautiful Bill Act (OBBBA)”, this complex bill includes a myriad of tax issues over hundreds and hundreds of pages. Most taxpayers have seen news, commentary, opinions, and reports about the OBBB, but many just want to know the answer to one question - How does this affect me?

As wealth managers, one of our primary goals is to stay apprised of changes that could affect our clients in the areas of retirement, tax, estate, investment, and preservation planning. While there was much packed into this act, we feel the following key items within the OBBB act are applicable to a large group of our investors and savers.

Current tax brackets were made permanent

The Tax Cuts and Jobs Act (TCJA)income tax brackets were scheduled to sunset at the end of 2025. These brackets are now permanent, saving millions of taxpayers from a tax increase. There is also a slight upward adjustment to the top of the 10% and 12% brackets, thereby granting a small amount of additional relief, starting in 2026. This isa sigh of relief for taxpayers that could have seen higher tax brackets, including the pre-TCJA highest tax bracket of 39.6%.

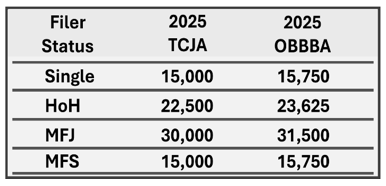

Higher standard deductions became permanent and expanded.

The TCJA nearly doubled the standard deductions while eliminating personal exemptions. The OBBBA made the higher standard deductions permanent and also provided a slight increase. Starting in2025, the deduction will be $15,750 for single filers, $23,625 for head of households, and $31,500 for married individuals filing jointly.

Additional temporary deduction for seniors.

There is a new deduction for taxpayers who have attained age 65 before the end of the tax-year (subject to phase outs). From 2025-2028, qualifying individuals can deduct up to an additional$6,000. The deduction phases out for incomes above $75,000 ($150,000 joint).This deduction is meant to partially fulfill the president’s campaign promise to eliminate taxation of Social Security benefits. However, Social Security benefits are not required to qualify.

State & local deduction (SALT) cap is raised.

Starting in 2025, the state and local deduction (SALT) is raised from $10,000 to $40,000, with a 1% increase in the cap each year through 2029 before returning to the $10,000 limit for 2030.

The$40,000 deduction cap is phased-down to the prior $10,000 cap for taxpayers with a modified adjusted gross income (MAGI) over $500,000. The phase-down occurs over a $100,000 range and therefore taxpayers with a MAGI of $600,000 or more are limited to a SALT deduction of $10,000.

The estate tax exemption is increased.

The TCJA doubled the estate tax exclusion amount, allowing individuals to pass on larger estates tax-free. The OBBBA increases exclusion from $13.99 million to $15 million ($27.98 million to $30million married couples). The exclusion was scheduled to reset to pre-TJCA law and would have been approximately $7 million for individuals in 2026. The OBBBA also made the higher exclusion permanent. The gift tax and generation skipping tax (GST) exclusion is the same as the new estate tax exclusion. This will provide meaningful relief to many families who may be subject to the estate tax but are not wealthy enough to undertake simple and effective tax planning. The stepped-up basis at death remains.

TCJA mortgage interest modifications made permanent.

The TCJA reduced the loan principal which could incur deductible interest from $1,000,000 to $750,000.

The TCJA also eliminated the deductibility of mortgage interest not attributable to acquisition indebtedness, for example, a HELOC used to pay bills.)

The OBBBA made these provisions permanent. However, the Act does restore the deductibility of mortgage insurance premiums.

The child tax credit was expanded.

The child tax credit has been increased by $200 and is now $2,200, effective in 2025. This credit is reduced or phased out for single filers with incomes above $200,000 ($400,000 jointly).

A new car interest loan tax deduction was created.

A new tax deduction for interest paid on new car loans is now available. The clincher is that qualified vehicles are those assembled in the United States. This deduction starts in 2025 and is set to expire at the end of 2028. This "above-the-line" deduction is capped at $10,000 annually and can be claimed without itemizing. This deduction phases out for higher earners (above $100,000 for single filers and $200,000for joint filers).

Qualified Business Income (QBI) deduction made permanent.

The Section 199A deduction, also known as the Qualified Business Income (QBI) deduction or the pass-through deduction, was enacted as part of the Tax Cuts and Jobs Act of 2017 to provide a tax break for many owners of small businesses. The OBBB made this 20%deduction permanent.

Starting in 2026, this bill also includes a minimum deduction of $400 for taxpayers with at least $1,000 of QBI from one or more active trades or businesses in which the taxpayer materially participates.

New Trump Accounts

The OBBB includes a new “Trump Account”. This is a tax-advantaged investment account that is prefunded with$1,000 for each child born from the beginning of 2025 through the end of 2028. Children born during this time are eligible for this IRA-like account option, but not the $1,000 initial deposit.

The goal of this new account is to encourage an early start on saving and investing early in life so that these children have a better opportunity to accrue savings by the time they are ready for larger life expenses, such as college, or the purchase of a home. While this Trump account has good intentions, it is rather complex and comes with a gamut of parameters that dull the attractiveness of the $1,000 throw in. Please remember, there are many other options for savings for children, such as a 529 plan, that may have greater tax advantages. If this is something you would like to explore, or you would like to explore other options for early jumpstart savings options, please consult with us.

No tax on tips & overtime pay.

There are now new provisions in the OBBBA that provide tax deductions for tips and overtime pay. These deductions are available from 2025 through 2028.

The deduction for tips received is up to $25,000. However, there are a number of qualifications, including that the tips must be received in an occupation which customarily and regularly receives tips, such as waitressing.

Individuals who receive overtime pay that is required only by the Fair Labor Standards Act (FLSA) that exceeds their regular pay are also entitled to a new deduction. This deduction is capped at $12,500 ($25,000 for joint filers).

Both of these provisions are phased out for earners making over $150,000 ($300,000 filing jointly).

The Bottom Line

Our goal is to update clients on any tax law changes that could affect their situation. There are many other provisions within the OBBBA that can affect many Americans. Some of you may be impacted by changes within the One Big Beautiful Bill Act, and some of you may not. With all the new information released and all the news sources providing their opinions, it can be confusing. Please keep in mind that the most important thing for you to do is to stay focused on your personal and unique goals and financial situation.

We believe in a proactive approach to your finances. If you would like to talk about item discussed within this article, or any other provisions that have piqued your interest, please call us.

Complimentary Financial Consultation

2025 is proving to be a year of change. There are a lot of people seeking clarity. Our goal this year is to help people just like you with their financial goals and decisions.

If you are not a client, we would like to offer you a complimentary financial consultation. Please call (714) 597-6510 or email info@fanwmg.com for more information or to schedule your appointment.

Financial Advisors Network, Inc. is a registered investment advisory firm.

This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer, tax or financial professional. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance is not a guarantee of future results. Investing involves risk and investors may incur a profit or a loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Sources: wallethub.com; nerdwallet.com; Experian.com. Contents provided by the Academy of Preferred Financial Advisors, Inc. ©

Turn Bulletins into Action

Stay informed—then come in for a free consultation and see how the updates apply to your financial life.